Last year, I had the privilege of speaking at the SAP Global Trade and Tax Conference in Amsterdam. My session, “The Role of Automated Tax Determination in a Tax Control Framework (TCF),” explored how structured VAT determination has become a critical element of modern tax processes. To understand its importance for VAT management, let’s take a journey—starting in 1996, when I first began my career, and reflecting on how our approach to controls and processes has evolved over time. You will see, as tax systems evolve and challenges mount, one question looms larger than ever—one that could redefine how businesses approach VAT compliance. What I mean by this, I’ll reveal at the end.

1996: Random Audits and Manual Controls

When I started my career at the tax authorities in 1996, VAT audits were often a matter of luck and randomness. A VAT return would land on my desk, and if something seemed unusual—or if IT flagged a deviation, such as a 10% increase in input VAT compared to the previous period—I would investigate.

The process was straightforward: I’d request a reconciliation, three invoices with VAT, and an explanation for the discrepancy. The responses I received were typically improvised: a hastily compiled reconciliation, invoices that appeared formally correct, and an explanation like, “We purchased more goods this month.”

With little structure to rely on, I closed most cases, satisfied that the company seemed to be “in control” of its processes. In hindsight, however, these investigations—and the companies’ responses—were based on intuition and ad hoc efforts rather than robust systems or controls.

A Turning Point: Addressing Under-Declared VAT

Years later, I worked with a company facing a serious VAT issue. During a review, it became clear that the company had under-declared millions of euros in VAT over several periods. The analysis revealed multiple issues: interface errors between systems, incorrect mappings, and insufficient time and resources for proper reconciliation. It was evident that the company had to present this to the tax authorities, but we knew we needed more than just an explanation of the problem; we needed a plan for the future.

We developed a new VAT return preparation process. Using Excel and an SQL database, we designed a system to reconcile transactions and structure analytics and workflows, with a focus on completeness and accuracy. When presenting this to the tax authorities, we framed it not just as a resolution to the immediate issue but as a broader improvement in the company’s internal controls. This approach proved successful: the company avoided penalties and began to rebuild its relationship with the tax authorities.

This experience taught me a crucial lesson: good processes are not just about efficiency—they are a layer of protection. Processes provide clarity, confidence, and, most importantly, trust when dealing with tax authorities.

2016: The Rise of Tax Control Frameworks

By 2016, the global approach to tax management was shifting. The OECD, in its work on Base Erosion and Profit Shifting (BEPS), emphasized the importance of Tax Control Frameworks (TCFs) as a means of ensuring transparency and compliance. Their publication “Co-operative Tax Compliance: Building Better Tax Control Frameworks” outlined the principles of proactive risk management, highlighting the need for companies to establish controls embedded in their processes.

In Germany, the release of guidance on Tax Compliance Management Systems (TCMS) based on the IDW PS 980 standard reinforced this trend in Germany. The publication “Praxishinweis zum IDW PS 980” states: “An effective Tax Compliance Management System aims to prevent or at least detect tax violations and errors at an early stage.”

Recently, in October 2024, HMRC began linking tax controls to operational processes such as order-to-cash and purchase-to-pay in their publications for “Making tax digital”. These developments made one thing clear: tax authorities were no longer content with clean VAT returns alone—they wanted assurance that companies were in control of the processes leading to those returns.

The message was consistent across jurisdictions: tax processes must evolve from being reactive to proactive, with well-structured controls playing a central role. This raised a key question for businesses: how can they meet these expectations effectively?

VAT Returns: The Role of Tax Determination

In recent years, companies have invested in control mechanisms and reporting solutions to improve VAT compliance. These investments—often focused on tools like SAP DRC for reporting and SAP TC for managing risks and controls—have strengthened companies’ ability to detect and address discrepancies.

However, this emphasis on detective controls has also created unintended challenges. Control reports generate numerous work items, each requiring investigation, analysis, and resolution. Tax teams must balance an ever-growing list of tasks while managing resource constraints and navigating increasingly dynamic and complex business models.

This is where the need for rebalancing becomes clear: shifting the focus from detective controls at the end of the process to preventive measures embedded at the beginning. Tax determination plays a central role in this transformation, streamlining processes and reducing the burden on tax teams.

A Comparison: With and Without Tax Determination

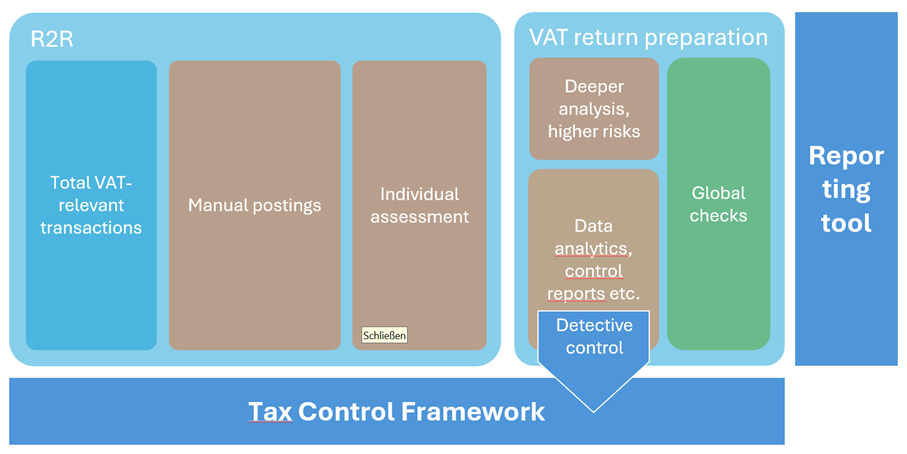

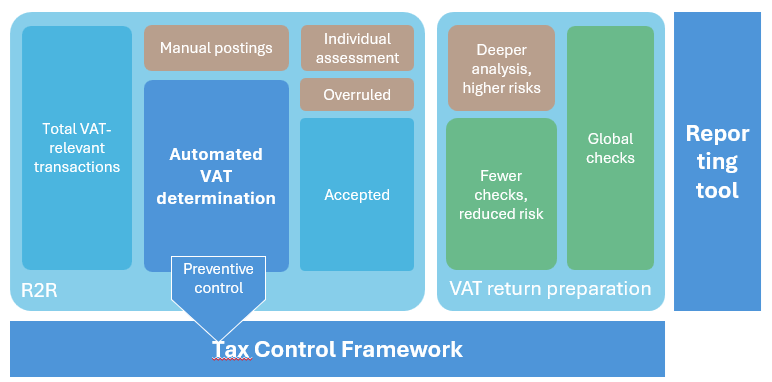

Let’s compare two simplified approaches to VAT return preparation:

Without automated tax determination

Imagine a company that takes VAT compliance seriously. Perhaps it has experienced a painful audit or identified gaps during a self-assessment. The company has invested in detective measures, such as data analytics and control reports, to identify potential issues.

While these tools provide valuable insights, they also generate numerous work items, each requiring manual investigation by qualified personnel. Success depends heavily on resources: skilled staff, sufficient time, and detailed attention to each flagged transaction. This reactive approach is labor-intensive and often unsustainable in a fast-moving business environment. Increased transparency may lead to more identified risks, which in turn demand additional controls—a cycle that puts immense pressure on the tax team.

With automated tax determination

In contrast, consider a company that adopts a digital-first approach, including tax automation. By implementing automated tax determination—whether as a cloud-based bolt-on, an ERP add-on, or a native system—the company embeds compliance upstream, ensuring consistent and accurate treatment for e.g. 90% of booking transactions. Please keep in mind that it does not have to be a tax determination tool. You can replace the function of VAT determination with a broader understanding of automation and support for decision-making.

This automation reduces the number of work items requiring manual review, allowing the tax team to focus on high-risk areas such as manual overrides or complex VAT scenarios. Predefined rules also address common VAT queries during the month, reducing interruptions for both tax and accounting teams . While periodic reviews of transaction mapping are still necessary, these can be outsourced to minimize internal workload.

Of course, the last example leaves out significant considerations such as the make-or-buy decision, vendor selection, developing the business case, navigating the implementation project, and addressing setbacks like master data clean-up or introducing new tax code concepts , and establishing a sustainable maintenance strategy. All this demands substantial effort from both the company and its people. These are critical aspects that warrant separate, detailed exploration. For now, the focus is on the end-state: a well-functioning system where the VAT manager or the VAT team still play a vital role. However, the tax department, freed from some routine burdens, can adopt a more strategic and creative approach, concentrating on initiatives that deliver real value to the business. But most important, the wave of additional work items does not continue to grow and does not bury the team.

Rebalancing Controls: From Detection to Prevention

Automated tax determination exemplifies the shift from detection to prevention. Rather than relying solely on control reports to flag issues after the fact, tax determination prevents errors at the source. This reduces the burden on tax teams and strengthens compliance by embedding consistency and transparency directly into the transaction flow.

Reflecting on my journey from random audits in 1996 to today’s structured frameworks, it is clear to me that the question is no longer, “Can we afford automated tax determination?” Instead, companies must ask, “How can we afford to operate without it?”. Whether through in-house solutions, external tools, or a setup designed to support VAT decision-making and automation. Structured VAT determination is no longer optional. It is a necessity in today’s fast-paced, complex business environment.